Hello! I’ve just finish the rest of PGP, for this year. Recently, in PGP, we’ve been working on planning our future and Marketing Me. This blog post is going to focus on Financing. In this project/section of PGP I created budgets, learnt about where to save, and how a stock market works. The driving question for this section was “How do I support my career life choices?”. Within this project I think I built my critical and reflective thinking skills.

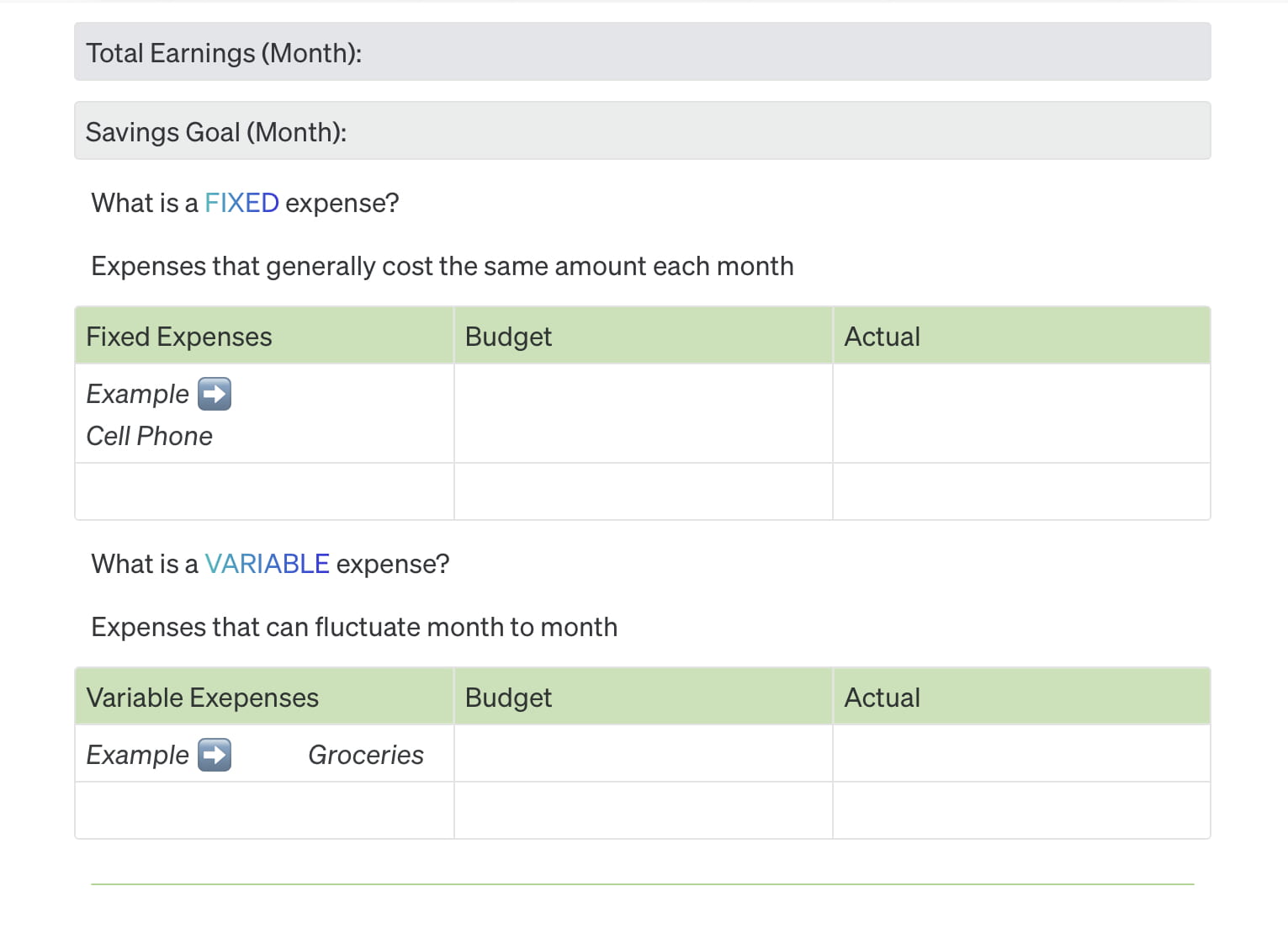

To start of ‘Financing’ in PGP I started with a somewhat of a keystone/checkpoint called “Budgeting Reality” in this activity I planned out my budget of Fixed Expenses vs. Variable Expenses. For the purposes of this activity we evaluated one month. If you don’t earn money consistently enough, we were tasked with choosing a month in which we did. If you didn’t remember what you spent in any one particular month, you estimated your expenses. This activity prepared me for the rest of the PGP activities and gave me insight into my budgeting.

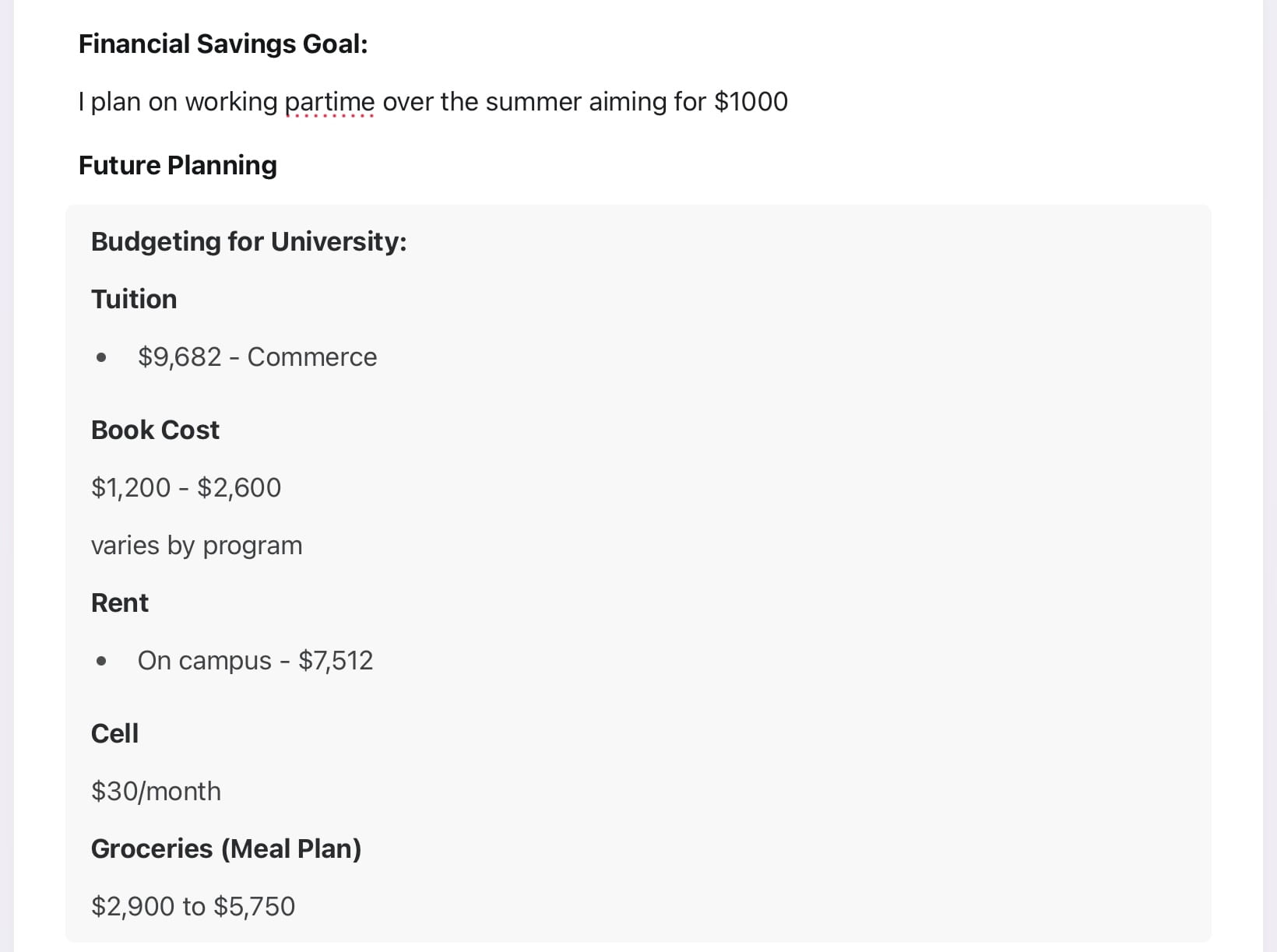

Next, I completed an activity called “Your Financial Future”. Within this learning activity I looked into different jobs to apply to in the summer and made a end goal for my summer earnings. I then looked into the average cost of different aspect of University. I think this helped me gain an idea of what my future would be.

The next topic I want to cover is called “Stock Market Challenge”. This was a big part of the end of the year because the whole class was basically in a competition to have the bigger stocks or the most ethical stocks (in a simulation). My goal was to go for ethical stocks, honestly if I didn’t go for ethical stock I think I would’ve had a big chance in winning the competition. To prepare for the stock market simulation I researched different types of Investments and Investments Strategies. I think this was an important step in this activity because it taught me the basics of stocks, something I wasn’t very familiar with.

After researching the basics of stocks I decided to do some researching on what ethical stocks I should purchase from. I narrowed it down to a few and decided what ones I wanted to purchase, and gave reasonings why in a reflection. After every week I would do a reflection about the progress of my stocks. By the end I was only up $167, but that was definitely improvement and I proud of myself for adapting to the ups and downs of the stock market.

During the stock market challenge I did other activities not directly associated with financing. We did an activity about our personality type. On a chart we located what personality type we thought we were from the options provided. After this we did an actual test. In addition to ourselves do the test we asked a peer, I chose Makenna, to do the test in the mindset of the other person. I then completed a reflection about the whole process.

Overall, this project was a great way for me to understand the concept of financing to ultimately help me succeed in my future endeavours. I think I really improved my use of critical and reflecting thinking through many aspects of this project. Now, onto the answering of the driving question “How do I support my career life choices?”. I think I can support my career life choices by effectively researching options that line up with my financial income. I can support and improve my financing by budgeting, being smart and understanding the situation I am in.

Thank you for reading! What stocks would you purchase?

Alicia 😀